Understanding the Performance of Your Trading Bot: What to Expect in the First Month

When deploying a new trading bot, it’s crucial to understand the performance dynamics during the initial phase. Our algorithm, Kong, is designed with a specific strategy that involves an initial period of smaller losses, followed by recovery trades that result in substantial gains. Here, we outline what you can expect during the first month of using Kong.

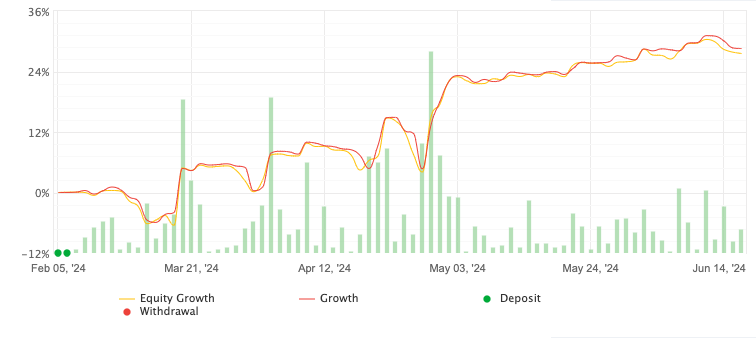

The following graph was taken from one of our personal accounts to highlight the individual stages:

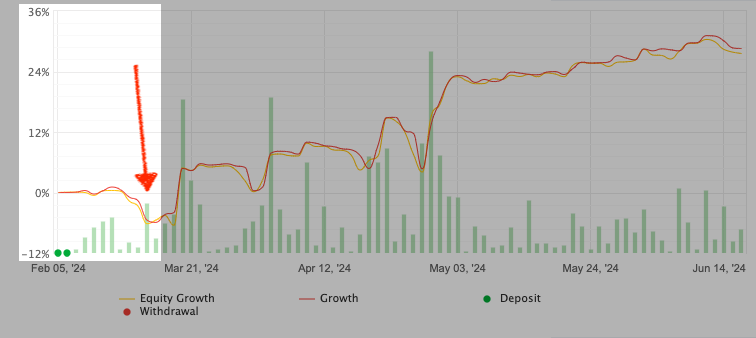

The Initial Phase: Understanding Smaller Losses

In the early days of operation, it’s common to see some losses on your account. This phase is critical for setting up the conditions necessary for the recovery sequence. The algorithm may not immediately enter into recovery trades, which can make it appear as though the account is predominantly losing. This is a normal part of the process and should not be a cause for concern.

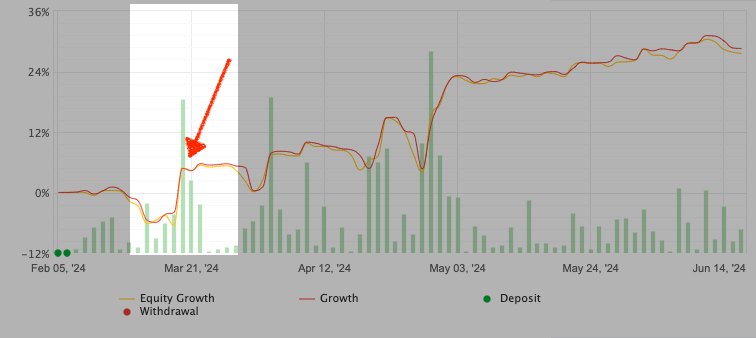

The Recovery Sequence: Turning Losses into Gains

Once Kong experiences a few losses, it initiates the recovery sequence. This is where the true potential of the algorithm becomes evident. The recovery trades are designed to not only recoup previous losses but also to generate additional profits. For instance, in one observed account, the first few weeks did not end profitably. However, after entering the recovery phase, the account not only regained all previous losses but also achieved an additional 30% in profits.

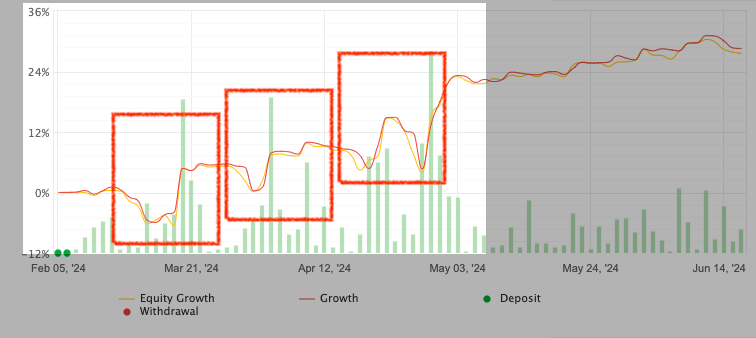

Pattern of Performance: Valleys and Peaks

Throughout the history of accounts using Kong, a consistent pattern emerges. There are periods characterized by smaller losses, often referred to as valleys, followed by recovery sequences that result in significant gains, or peaks. This cyclical pattern of performance—losses followed by larger gains—is a hallmark of the algorithm's strategy.

Setting Expectations: Patience is Key

Given this performance pattern, it’s important to have patience and allow the algorithm to operate over a sufficient period. We highly recommend evaluating the performance of Kong over at least one month before drawing any conclusions about its profitability. This timeframe allows for the natural cycle of losses and recoveries to play out, providing a clearer picture of the algorithm’s overall performance.

Conclusion

In summary, the first month with Kong is a period of adjustment where the algorithm sets the stage for future gains. While initial losses may occur, the subsequent recovery trades are designed to offset these and achieve net positive results. Understanding this dynamic is essential for managing expectations and making informed decisions about the long-term use of the trading bot.

By allowing Kong to operate for at least a month, you give it the opportunity to demonstrate its full potential, turning early losses into substantial gains and achieving the expected outcomes.