Validate contract size

This section will explain which symbol to choose and what you need to look for when picking your symbol.

Understanding the contract size for your broker is crucial for configuring Athena. Please make sure you verify the correct symbol with the appropriate contract size!

Symbol

Athena trades on the German-40 (DAX) index. The index uses different names depending on your broker such as:

- DAXEUR

- DAX40

- DE30

- DAX30

- DAX

- GER

- GER30

- GER40

Contract size

In MetaTrader, "contract size" refers to the amount of the underlying asset that a single lot represents in a trade. It defines the quantity of the asset that you are trading when you open a position.

Each symbol will have a pre-defined contract size.

Contract size explained

Here’s a breakdown of how contract sizes work:

- Standard Lot (1.0)

- For the DAX (GER30) index, a standard lot typically represents €25 per point. This means that for every point the DAX moves, a position of 1 standard lot will gain or lose €25.

- For example, if you buy 1 lot of the DAX and the index moves up by 10 points, your profit would be €250 (10 points x €25 per point).

- Mini Lot (0.1)

- A mini lot in the DAX index represents €2.50 per point (1/10th of a standard lot). This provides smaller exposure and allows for more granular control of position sizes.

- Using the same example, if the DAX moves up by 10 points, and you have 0.1 lots, your profit would be €25 (10 points x €2.50 per point).

- Micro Lot (0.01)

- A micro lot represents €0.25 per point (1/100th of a standard lot). This is ideal for traders looking to manage risk with very small positions.

- If the DAX moves by 10 points, with 0.01 lots, your profit would be €2.50 (10 points x €0.25 per point).

Example of Lot Size Impact: Let’s say the DAX moves from 16,000 to 16,020 (a 20-point move):

- If you had opened a position with 1 lot, your profit/loss would be €500 (20 points x €25 per point).

- With 0.1 lots, your profit/loss would be €50 (20 points x €2.50 per point).

- With 0.01 lots, your profit/loss would be €5 (20 points x €0.25 per point).

Margin Requirement and Risk Management

- Margin: Trading larger contract sizes, such as 1 standard lot, requires more margin, meaning you need to have sufficient funds in your account to cover potential losses and to maintain the position.

- Risk Management: Understanding how lot sizes affect your exposure is crucial. Smaller lot sizes like mini and micro lots allow you to manage risk more effectively by limiting the impact of price movements.

This example is typical for many brokers, but it’s important to check with your specific broker, as contract sizes can vary slightly depending on their platform.

Check contract size

In order to check your specific broker's contract size for the DAX index, follow these steps:

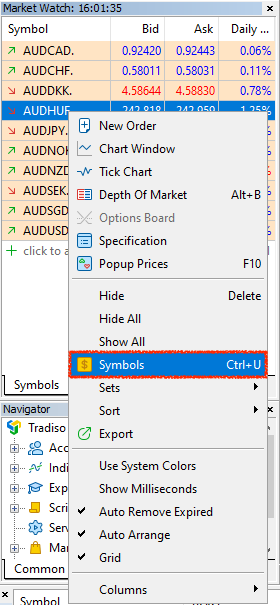

-

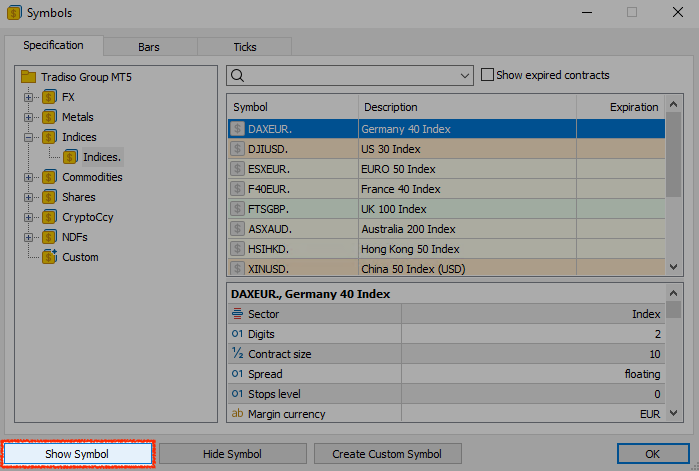

Right click inside the Market Watch panel of your MetaTrader 5 window and select Symbols

-

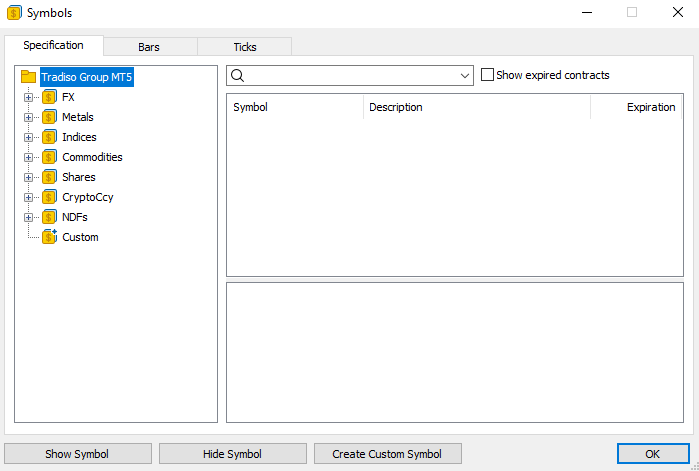

You will now see a list of categories for the available symbols

-

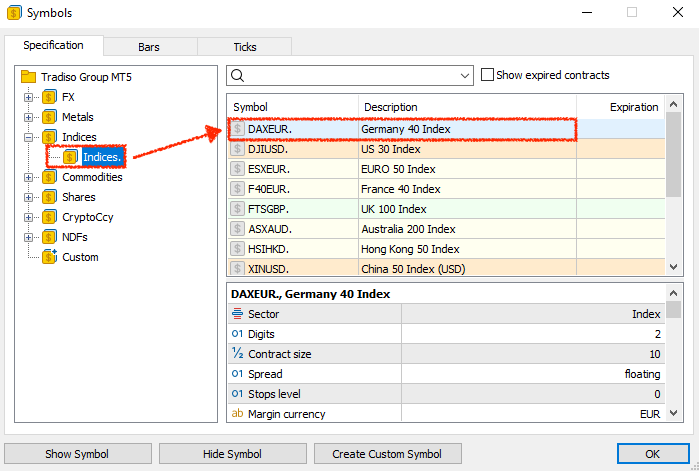

Next, find the category containing the German-40 index (DAX)

noteMost brokers will have a Indexes category containing the DAX index (GER40, DAX40, GER30, GER, DE30, DAX30, etc.).

-

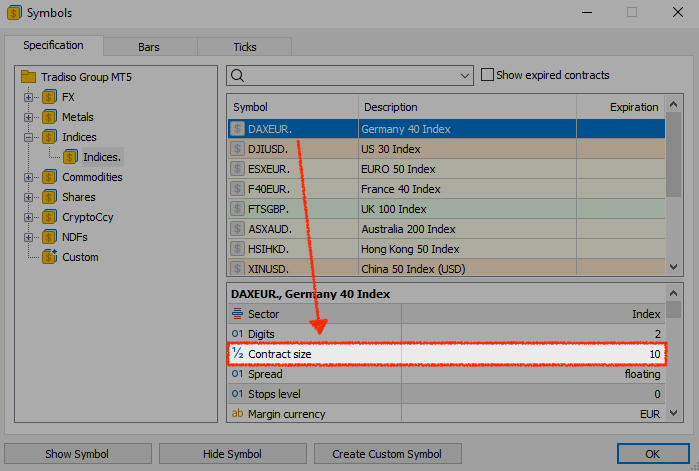

Left click on the DAXEUR symbol and you will see every property of the selected symbol, including the Contract size setting

success

successIn this example, we can see that the contract is

10! We require a contract size between 1 and 25!dangerIf the contract size is too large (e.g. 100), please check all other categories in the Symbols menu. We require a contract size between 1 and 25!

-

You can now click on "Show Symbol" to show the highlighted symbol in the "Market Watch" panel:

We have now successfully identified the DAXEUR symbol and verified the correct contract size!